Donation receipts help both you and your donors track the contributions that are made to your organization for the year. These receipts provide your organization with a clearer view of your annual fundraising efforts and help you predict next year’s flow of income. Official documentation of donations also provides your donors the information they need for any tax deductions they make.

Learn more about how to create donation receipts and how they help your organization.

- What are donation receipts?

- Why are donation receipts important?

- When are donation receipts required by the IRS?

- What should be included in a donation receipt?

- Frequently asked questions about donation receipts

- How can I improve the donation receipt process?

What are donation receipts?

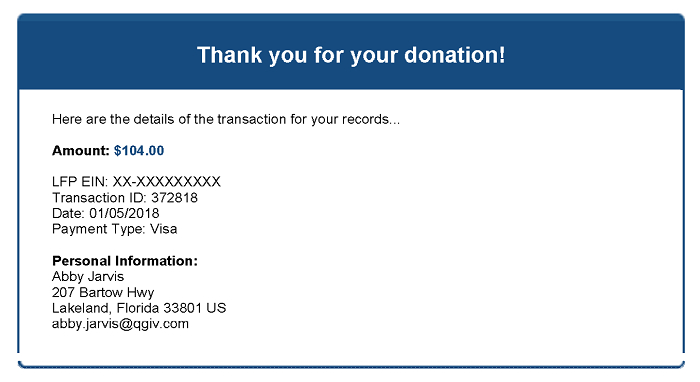

A donation receipt is a document that indicates a donor made a monetary or in-kind contribution to a nonprofit organization. This document is sent to your supporter in the form of a letter or an email. Often, donation receipts double as thank-you letters for donations while also providing any necessary tax information your donors may need to make deductions.

How soon should you send out the receipt?

Some nonprofits send receipts out at the end of the year the gift was given or in January of the following year. However, it’s better to send out donation receipts sooner rather than later because your donors are more likely to give again if their donations are acknowledged within the first 48 hours.

Sending receipts should be the next step after receiving a gift from your online donation page. Set up your donation form so your donors receive a personalized email right when their donation is made. Not only are you giving your donors assurance that their donation went through, but you’re also making sure their generosity doesn’t go unnoticed.

What are the types of donation receipts

Consider creating templates for each type of donation you receive most often. Develop receipts for online donations, cash gifts, recurring donations, in-kind donations, and an end-of-year receipt to wrap up the year for your donors.

Why are donation receipts important?

For donors

- Deductions on Tax Returns: To receive the tax deductions associated with charitable giving, your donors need documentation.

- Confirmation: Providing donation receipts lets your donors know their contributions have been received.

- Financial record keeping: Donation receipts help your donors keep track of their finances regarding charitable giving.

For nonprofits

- Legal requirements: The IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty of $10 per contribution, up to $5,000 for each specific campaign.

- Tracking donation history: Sending out donation receipts is another way your organization can track individual supporters’ donation histories.

- Accounting: Donation receipts also provide your organization with clear and accurate financial records.

When are donation receipts required by the IRS?

While it’s best practice to always send a donation receipt for every gift your organization receives, there are circumstances where a donation receipt is required by the IRS and must meet IRS guidelines, including:

- When single donations are greater than $250.

- When a donor received goods or services in exchange for a single donation greater than $75.

- Whenever a donor requests a donation receipt.

Common exceptions

There are a couple of common exceptions to these required donations receipts, including tokens and memberships.

Tokens

The token exception applies when nonprofits provide donors with insubstantial goods or services in exchange for a donation. The IRS defines goods and services as insubstantial if the item is small and the organization informs the donor that the value is insubstantial and the full donation can be deducted.

The guidelines for organizations to determine the value or benefit of an item is found in the inflation adjustment of revenue procedures for the current year.

Memberships

The membership exception states that nonprofit organizations don’t have to provide a receipt for insubstantial goods and services given in exchange for contributions made by donors who have annual memberships. The exception for donation receipts applies when goods and services are given in exchange for memberships under $75 and consist of rights or privileges that occur annually.

The IRS defines these privileges as:

- Free or discounted admission to the charitable organization’s facilities or events

- Discounts on purchases or preferred access to goods and services

- Admission to member-only events if the per person cost isn’t more than $11.70

- Free or discounted parking

What should be included in a donation receipt?

Here’s what you should include in your own donation receipts according to IRS requirements:

- The organization’s name

- The amount of money or a description (but not the value) of the item(s) donated.

- If no goods or services were given to the donor in return for the contribution, the nonprofit must say so.

- A good faith estimate of the value if goods or services were provided to the donor

- A statement if the goods or services provided by the organization consisted only of intangible religious benefits

- A disclosure, if necessary. These vary from state to state, so make sure you’re including the required disclosure statements for all states that your donors are contributing from.

Remember: You do not need to include a donor’s social security number or tax ID number.

As a best practice for creating your donation receipts, consider including the following information for your donors’ benefit:

- The donor’s name

- The donation date

- Your organization’s federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3)

- An acknowledgement of gratitude for the gift given to your organization

- The name and signature of an authorized representative, such as a board member or head of the department

Donation receipts FAQ

There are a few more things you should probably know about donation receipts. Some frequently asked questions are:

Are donation receipts tax deductible?

Charitable donations are tax deductible up to a specific percentage of your donors’ gross adjusted income, often up to 60%, depending on the type of donation made.

What happens if a donor has their donation deducted from their paycheck?

Many donors enjoy the ease of giving to an organization straight from their paycheck.

If this is the case, your donors can use the following documentation as a donation receipt:

- A pay stub, W-2, Wage & Tax Statement, or other employer document that delineates the withheld amount.

- A pledge card that includes a statement that the organization didn’t provide goods or services in exchange for payroll-deducted contributions.

Each payroll deduction of $250 or more is treated as a separate contribution and is not aggregated.

What about donations exchanged for goods or services?

If your donors received goods or services in exchange for a donation greater than $250, the donation receipt must describe those goods or services and provide a good-faith estimate of their value. Your donors must subtract the value of the goods or services from the contribution amount. This is especially important when you’re taking registrations for a fundraising event. For example, if the price of a ticket for a fundraising dinner event is $250 and the organization estimates the value of the meal provided is $100 per ticket, then your attendees tax deduction would be $150.

Goods or services include: cash, property, benefits, or privileges. However, there are exceptions when it comes to goods and services. These exceptions take the form of: Insubstantial goods and services, membership benefits, and intangible benefits.

What about unreimbursed expenses?

Your donors must secure a donation receipt if they give more than $250 in the form of unreimbursed expenses (i.e., transportation costs paid to perform donated services) which also includes a description of the services your donor provided. Additionally, your donors must keep a record of these expenses.

When does a donor need an appraisal for a donated item?

If your donors are claiming contributions valued at over $5,000, they need an official appraisal made by a qualified appraiser to receive the adequate tax deduction.

How do donation receipts work for donated vehicles?

If the vehicle’s value is between $250 and $500, you can use a standard donation receipt. Your donors require a timely acknowledgment if your organization sells the vehicle. The deduction your donors can make for the vehicle is generally limited to the sales price when sold by your organization. However, your donors are able to deduct fair market value if your organization makes significant intervening use of the vehicle, makes major repairs that increase its value, or sell the vehicle significantly below market price to a person in need.

How can I improve the donation receipt process?

The right fundraising solution makes compiling and sending out receipts easier than ever.

Qgiv can help your organization:

- Collect the right data with customized donation forms

- Create personalized receipts for donors and for specific gift types that engage your supporters

- Automate generating donation receipts after a gift is made

- Store and manage all donation receipt information in a fundraising database

Final thoughts

Donation receipts are a crucial part of the online giving process, for both you and your donors’ sakes. Receipts confirm gifts made to your organization and are a great way to highlight the work your organization has accomplished. With these donation receipt best practices in mind, you can boost the value of your donation receipts for your organization and your donors alike!

Additional resources

- Interactive Donation Form Templates. The layout of your donation form has a major impact on donor conversion rates! Should you use a multistep layout or is a single step form the best answer? We put together these interactive donation form templates to help you decide!

- Donation Form Check-Up Checklist. Use this handy checklist to tick off important parts of the online donation process!

- Digital Fundraising Guide: Ideas and Steps to Reach Your Goals. This eBook will walk you through the process of choosing the right digital fundraising solution for your nonprofit’s specific needs.