When we surveyed 1,300 people for our Generational Giving Report, I was pretty sure I knew what we would find. Some of the findings were what I anticipated: Baby Boomers were most likely to give through direct mail, younger generations like to see nonprofits active on social media, etc. But some findings were surprising!

These are the top 3 most surprising findings from the Generational Giving Report. I hope they surprise (and delight!) you as much as they did us!

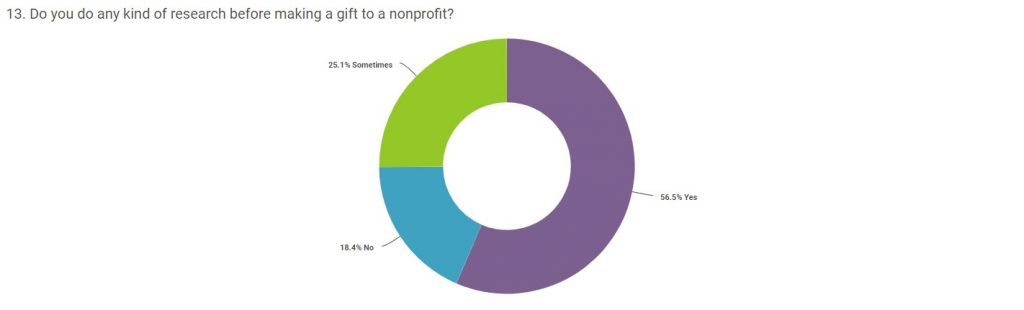

Most people research charities before donating

Deciding to give is an emotional process! We know that getting donors invested in a cause, building emotional connections between donors and the cause, and making them feel great about giving are all important fundraising practices. We design donation forms to reinforce those feelings. And we build confirmation pages and receipts that make donors feel fantastic about their gift. So, we were a little surprised when our study revealed that 56% of the people we surveyed researched an organization before giving. That research included everything from checking media coverage about the nonprofit to looking at their financial reports to browsing their social media to vet their work.

What you can take away from this:

Yes, giving is an emotional process. When a donor gives to you, they’re investing their money and their emotions in your work. But donors are also rational: you may draw them by showing them heartwarming stories, but you’ll still need to show them you’ll use their money wisely.

Young people are most likely to see giving to charity as part of their identity and legacy

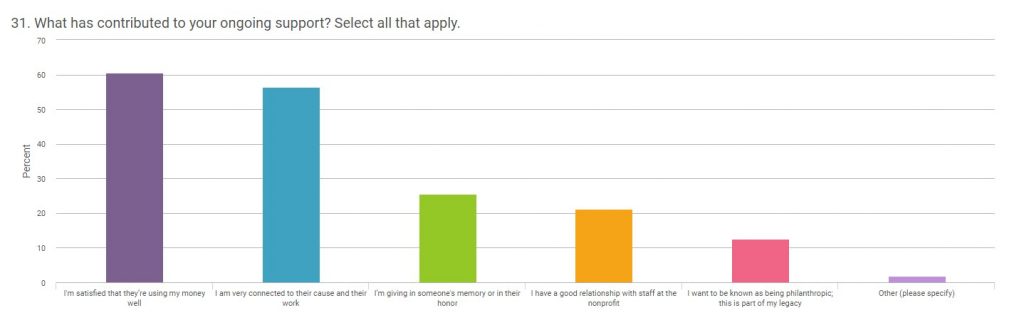

Personally, this was my favorite finding. It’s also the finding that surprised me the most! When we built our survey, one of the questions was “If you’ve supported a nonprofit with multiple gifts over a long period of time, what contributed to your ongoing support?” One of the possible answers was “I want to be known as being philanthropic; this is part of my legacy.” 13% of respondents chose that as one of their answers. I assumed most of the people who picked that answer would be from the Baby Boomer generation. I was wrong! The generations that were most likely to answer this way were Generation Z (33%), Millennials (23%), and Generation X (33%). Only 11% of Baby Boomers chose this answer.

What you can take away from this:

People are always looking for charitable giving trends that will help them relate to their younger donors. Your younger donors already view their charitable giving habits as part of their identity. Add this to your 2020 charitable giving trends list: giving isn’t a trend for your Generation Z donors! Not all of them are philanthropic powerhouses yet (Generation Z is still young!), but don’t write them off. They’re going to change the world.

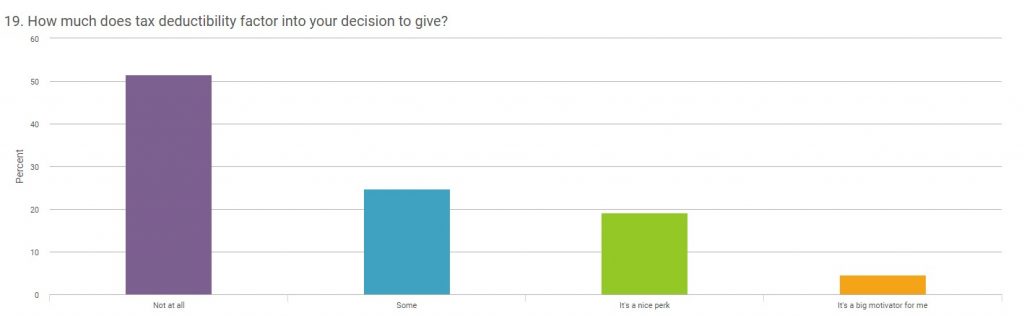

People are remarkably unmotivated by tax deductions

We asked, “How much does tax deductibility factor into your decision to give?” Of the people who responded, 51.6% answered “not at all,” and 24.7% answered it mattered “some.” An even smaller percentage said tax deductibility was “a nice perk” (19.1%) and only 4.6% said “It’s a big motivator for me.” That was so reassuring! Many nonprofits were worried about individual giving going down when tax laws changed, so seeing more than half our survey respondents say tax deductibility wasn’t that important to them was refreshing.

The part that surprised me, though, was seeing which generations were most motivated by tax deductibility. I really thought Baby Boomers would be most motivated by tax deductibility, mostly because they’re the generation that tends to give the largest portion of charitable donations. I was wrong again! Only 18.3% of Boomers said they were motivated by tax breaks. Instead, the generation that found them most motivating were Generation X donors. 41.7% of them indicated that they were highly motivated by their gift’s tax deductibility.

What you can take away from this:

More than half your donors aren’t really motivated by tax deductions, so don’t worry too hard about communicating about tax breaks on your donation form itself. Instead, communicate about tax deductibility in later communications like receipts and donor summaries. That will let you keep the content on your donation form limited to what works for most donors (hint: they want stories and great images) while still communicating about tax benefits with those who want that information.

A quick note about tax deductibility right now:

While the majority of donors aren’t highly invested in tax breaks for their gifts, it’s always good to know what’s going on with those are ARE motivated that way. Since the CARES act went into effect, there are a couple of changes to tax deductibility rules. Here’s a quick breakdown:

For folks filing as non-itemizers, there is a $300 above-the-line charitable deduction for cash donations made in 2020. This means that if you’re taking the standard deduction and you gave $300 to charity, you’ll get the $300 break on top of the standard deduction. This excludes gifts into donor-advised funds and 509(a)(3) supporting organizations. While the summary of the bill said that this only applied to 2020, the actual text of the bill that was signed into law states that it applies to tax years beginning in 2020. This is a good start towards the higher or no-cap deduction nonprofits have been seeking for years.

The CARES Act temporarily suspends adjusted gross income (AGI) limits for charitable deductions for cash gifts made by individuals and businesses. This also excludes gifts to donor-advised funds and 509(a)(3) supporting organizations. For individuals, the adjusted gross income limitation is suspended for 2020. For corporations, the 10% limitation was increased to 25% of taxable income.

You can learn more about the CARES Act and what it means for nonprofits in this article!

Want to learn more about how different generations of donors give?

Download the complete Generational Giving Report! It includes a breakdown of the entire survey, plus profiles and summaries for each generation. It also includes engagement checklists for each generation of donors and a special section on how donors interact with Giving Tuesday campaigns!